How to profit from Latest Action of US Federal Reserve Chairman Ben Bernanke.

Timing in life is everything.

|

If you were considering selling real estate, here is why you should sell today.

See the carefully researched facts below.

Every time rates go up, the price of your investment property goes down.

May 1st 2013 base index US 10 year US Treasury CMT interest rate yields were at their low of 1.66%.

Interest rates had gone up 1.32% to their recent high peak of 2.98% on September 5, 2013 based on the market’s fear expectation that the fed will begin ending its fiscal stimulus program.

That??? san 80% rate increase from their lowest base rate yield index rate cost of borrowing!

Source:U.S. Government Federal Reserve & US Department of the Treasury

Date Rate Yield on U.S. governmentsecurities Treasury constant maturity 10 Year index rate

7/25/2012 1.43% All Time Historic LOW

5/1/2013 1.66%

6/20/2013 2.41% U.S. Federal Reserve Chairman announces future end to quantitative easing.

9/5/2013 2.98% Expectation of Fed to begin reduction of quantitative easing

9/18/2013 2.76% Ben Bernanke US FedChairman announces postponement of reduction of quantitative easing.

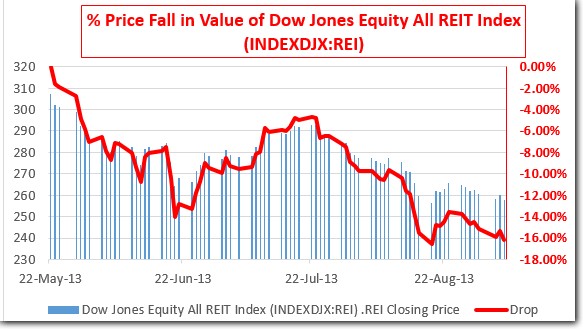

See the *effect below that this rate increase has had SO FAR on the value of real estate.

* Effect: The total value of All Real Estate Investment trusts in this index has fallen 16.14% from its 12 month peak since the announcement that quantitative easing will be terminated.

Time frame: 5/1/2013 to 9/5/13

The index represents all publicly traded real estate investment trusts that own and operate income-producing real estate in the Dow Jones U.S. stock universe.

May 1, 2013 302.03

May 22, 2013 (12 month High) peaked at 317.75

September 5,2013 closed at 257.65

9/18/2013 279.15

May 22, 2013 the market peak of real estate values was clearly reached and peaked.

Prices have clearly begun to fall.

This is why, if you were considering selling real estate, you should sell today.

LichtensteinRE has recently been exclusively engaged to sell the investment real estate of several keen real estate owners who share our belief that they should lock in today’ s very highest price possible to take advantage of this current seller???s price bubble before it becomes too late.

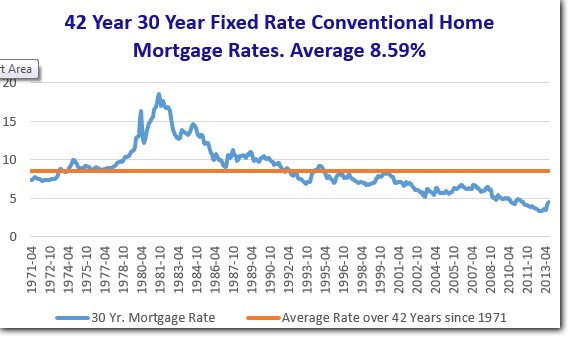

Looking back at interest rates over the past 42years from 1971 to 2013, 10 year long term fixed commercial mortgage rates which closely parallel 30 year conventional fixed rate home mortgages rarely went lower than 5.23% and actually averaged 8.59%.

Today, DoctorMortgage.com can refinance and lock a commercial real estate owner’s property or for a real estate buyer and investor sub-5% long term fixed rate interest rates, or as low as 3.375% for short term fixed rates.

The well timed real estate investor can still take advantage of these quickly disappearing historically low rates.

Here is the good news:

The best part is that LichtensteinRE has successfully sold New York City real estate for owners and in many cases helped them trade up and enjoy1031 tax free real estate exchanges into other higher cash flowing real estate.In some cases our 1031 exchange clients have tripled their post-sale cash flow.In some other cases exchangers have been able to convert their net income into what was previously their gross income.

Call LichtensteinRE and ask for a free 1031 exchange forecast to see if you too will benefit with higher cash flow.

LichtensteinRE will sell your property for the very highest price possible.

Email or call Andrew Lichtenstein President of LichtensteinRE at 800-242-9888 AL@LichtensteinRE.com.